Emergency Savings Product Background

-

There was very little empirical research that examined the effectiveness of a payroll deduction, or any other proposed solution. Evidence for emergency savings solutions tended to be correlational or anecdotal.

-

One popular strategy used in the market was automatic payroll deduction into an emergency savings fund through an employer-sponsored rainy-day account

-

Bundling the decision to save for emergencies with other regular routine choices or actions (e.g. bundling saving for emergencies and paying off loans)

-

Education-based programs: the evidence is conflicting

-

Evidence against: Meta-analysis in 2014 found that the intervention could only explain 0.1% of the variance in financial behavioral studies

-

Evidence for: An updated meta-analysis found positive effects of financial education

-

-

Interactive customized guidance platforms: require many efforts to build

-

Included financial education feed, personalized messaging, the library of educational content, interactive money management tools, and financial assessment at the end

-

my impact

7%

the team

I worked closely with a senior behavioral scientist and 4 financial advisors from the savings product line to understand stakeholders' intentions, uncover users' frustrations, and proposed a prototype to address all parties' needs.

methodology

-

I spent 1 week completing an exhaustive background search on barriers to enrolling in emergency-saving services and academic research on the root causes of the problem

-

Then, my team and I spent 2 weeks conducting interviews with financial advisors to learn the product's aim and business goals

-

My team and I also analyzed user data to generate insights on clients' performances and barriers to act

diagnosis

emergency savings: employer-sponsored rainy-day savings account

Why could this work: the mechanism of this strategy is based on default, through the preselected to nudge clients to stick with automatical savings for emergencies without extra actions (Beshears, 2020)

emergency savings: Choice bundling

-

How it worked: The company or plan provider bundled the act of saving for emergencies with other regular, routine financial transactions, such as paying off loans or using a debit card to make purchases

-

Why could this work:

-

It approximated an automatic contribution schedule by tacking the savings onto another payment schedule

-

Could reduce choice complexity by bundling two financial decisions into one

-

Could reduce the "pain of paying" by virtue of (1) rounding up small amounts to an emergency savings fund and (2) combining two payments into what psychologically felt like only one payment

-

emergency savings: Interactive customized guidance platforms

-

Why could this work:

-

May help overcome choice overload: specific suggestions were customized and shown to users

-

Personalization: participants may be more likely to adopt the guidance because the guidance was specifically tailored to their circumstances

-

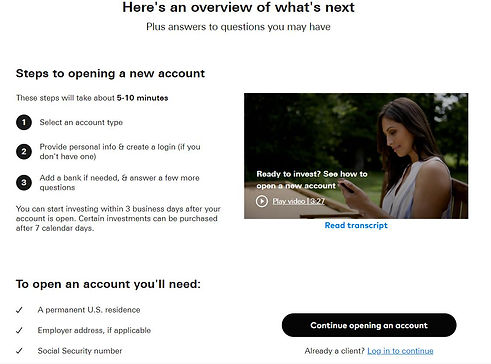

emergency saving solutions: Rainy-day tool

How this solution worked: My team and I developed a digital rainy day tool, in that various account options were shown to clients when applying for the emergency savings program. Then clients can decide which account to use and customize the contribution amount.

Why could this solution be effective:

-

Personalization: participants may be more likely to adopt the guidance because the guidance is specifically tailored to their circumstances

-

The tool gave advice about how much to save and where to save for two types of emergencies (unexpected expense and job loss)